For mortgage brokers and finance professionals.

Everyone knows they should be on social media (you do, right?). But very few businesses actually think of a social media marketing strategy before putting themselves out there. In fact, only 23% of financial advisors have a defined social media marketing strategy (Amra and Elma, 2025). Then they get discouraged when they don’t see instant ROI, leads, enquiries, engagement, and so on.

This article isn’t about some cool buzzwords and things that only sound nice, but bring no value. It’s about evidence-based best practices that work in 2025 and beyond. It breaks down a 7-step social media marketing strategy for mortgage brokers in 2025, covering audience research, content pillars, posting frequency, platform selection, and engagement.

After reading it, you’ll be well-equipped to create a strong social media marketing strategy for your mortgage business.

1. Define your social media goals first

It’s easy to jump straight into Canva, choose the first template you like, and create content straightaway. But before you do that, you really need to think about what is the intention behind your social media presence.

Yeah, of course, everyone wants leads. And that will be the most common answer. But let’s unpack that – because leads don’t happen in a vacuum. They are the result of a bigger ecosystem that includes visibility, trust, engagement, and your personal brand.

So you need to ask yourself:

- Do I want more eyes on the business?

- Do I want to dominate my local market or beyond?

- Am I trying to attract first-time buyers, investors, or another niche?

Make your goals Specific, Measurable, Attainable, Relevant, and Time-bound (SMART)

2. Know your audience (no, like really)

If you don’t know who you’re speaking to, then nobody will listen. You need to know exactly the pain points (problems) of your target audience.

In 2025 and beyond, understanding your audience is more important than ever. With more and more people looking to disconnect from social media channels, it means that your content needs to really resonate if you want anyone to pay attention.

- 60% of social content in 2025 prioritises value over promotional messaging, reflecting audience fatigue with push-only content (Hootsuite, 2025)

- 48% of consumers interact with brands more frequently now than six months ago – meaning engagement and relevance matter (Sprout Social, 2025)

But how do you actually research your audience?

You can of course get to know them while you work with them. Making note of what they usually ask about, and what are their common concerns.

But on a wider scale, search engines are your best friend. And I’ll show you exactly how to research your target audience.

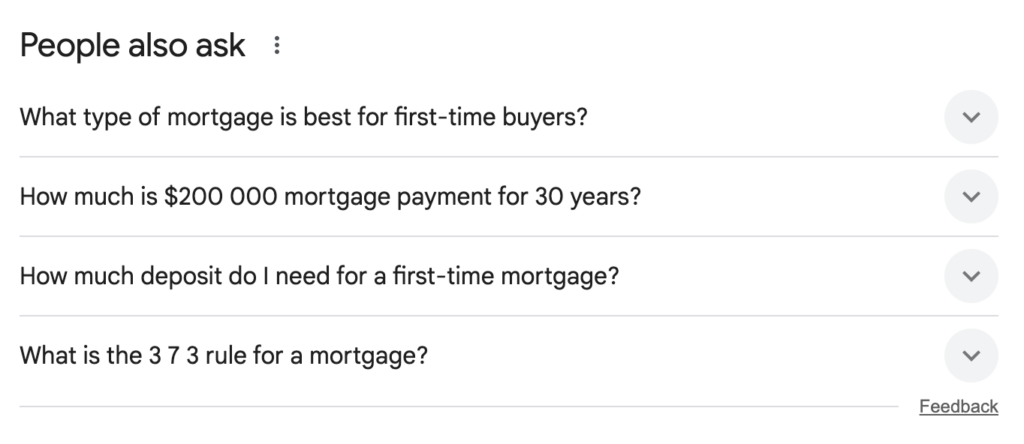

Let’s say you want to speak to first-time-buyers. You go to Google and search “mortgage for first time buyers”. When you scroll down, you’ll find something like this.

Google’s “People Also Ask” is one of the easiest free tools to validate your audience’s real questions.

Now you have 4 common phrases that first time buyers also search for, when typing this specific prompt. And that’s only Google.

You can do the same thing for pretty much every single social media platform. Each acts like its own search engine.

If you go to each social media platform and type a relevant keyword you want to research, you will see some form of “people also searched for”. You can also see what kind of content shows up, what do people interact with, and what do they find value in, as well as read conversations in the comments.

There is also a shortcut to this – Answer the Public.

You type in the keyword, and it does the heavy lifting for you by analysing a few search engines at once. PLUS it actually gives you insights from ChatGPT prompts. A huge value given the current market shift, and more and more people turning to AI to save time on searching manually.

3. Pick the right platforms

What are the right platforms? You tell me.

They’re essentially where your audience is. Do you want to speak to regular customers, or maybe business owners? Do you want to catch them in work mode, on platforms like LinkedIn, or maybe where they hang out after work, like TikTok?

My personal advice (based on where I’ve seen most success for my mortgage broker clients):

- LinkedIn for B2B, and thought leadership (KEO Marketing, 2025)

- Instagram drives visual storytelling and brand awareness for younger audiences (FlockSocial, 2025)

- Google My Business as an absolute non-negotiable for local recognition, and search engine visibility (Broker Studio, 2025)

If you’re doing it solo, choose 1 platform to focus on. If you’re working with a social media manager, they can spread your efforts across 2-3 platforms to expand reach.

3. Craft content around customer journey

Your content must be tailored towards each stage of the customer journey.

- Awareness – educational content that solves basic questions

- Consideration – authority-building content that demonstrates expertise

- Conversion – actionable content with strong CTAs (call to action)

This multi-stage approach improves trust and increases lead quality more so than random posting without a clear purpose (Adobe For Business, 2025).

4. Build content strategy based on the 4 pillars

Your content needs variety to stay engaging and to move people through different stages of the buyer journey.

My 4 content pillars for mortgage brokers.

- Educational: Give away some of your expertise for free before you expect anything in return. Make your audience feel like you know your stuff.

- Authority: Share industry news and case studies.

- Human content: This is the one many brokers skip right past (while it’s one of the most important ones). You need to let your audience in on the behind the scenes, show your face, etc. It builds familiarity. Something that businesses had no chance of achieving before social media.

- Promotional: Talk about the services you offer, who do you help, and what can you do for your clients. Let the audience attach your social media presence to a service.

5. Show up consistently

It’s one thing to have that perfect social media strategy sitting in your planner. It’s another to actually put it into practice. The thing is, any social media strategy, if executed in a floppy, inconsistent way, just loses its impact. You need to commit to showing up for yourself and your business enough times for people to take mental note of who you are and what you offer.

Showing up on social media makes your audience feel like they know you, because they’ve seen you enough times. It takes at least 7 digital touchpoints for a customer to make a purchase decision (Forbes, 2023). Sometimes more.

For mortgage brokers, I recommend:

- 3 posts a week minimum on platforms like Instagram, Facebook, LinkedIn

- Daily stories on platforms like Instagram and Facebook

6. It doesn’t end with posting – prioritise engagement

It’s not just posting that matters. How you interact on the platform is just as important. If you post and ghost, then it’ll be hard for you to grow. You need to engage daily:

- Respond to comments on your posts

- Like and comment posts in your niche

- Participate in conversations you see online

Posts with active comment replies perform up to 2x better in reach (Sprout Social Index, 2025)

Social media is not your broadcast channel. You need to use the platforms the way they were intended to be used. A two-way interaction.

7. Analyse and learn

Social media presence is not a one-size-fits-all kind of thing. A viral post from one brand might be copied word for word on your account and not achieve the same results at all. That’s why it’s important to:

- Post

- Learn

- Optimise

- Repeat

It’s also crucial to know, that any social media strategy needs to be tested for around 3 months before you can notice any patterns (Buffer, 2025). So don’t test something once, get discouraged and give up. Give it time.

And there you have it. A 7-steps social media marketing strategy blueprint to truly make your mortgage brokerage stand out, and build trust and credibility.

I use the strategy myself, while creating strategies for my own mortgage brokers clients’ so you can rest assured it’s been tried and tested.

And if you’d like to work with me, fill out the form below, or send me an email at [email protected]